Archivo: Leverage Ratios

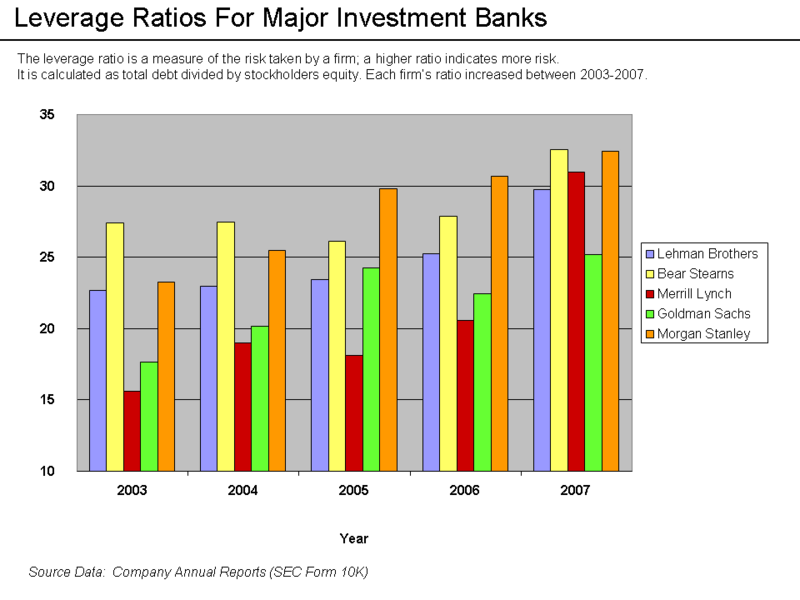

Descripción: Leverage ratios of investment banks Explanation Each of the five largest investment banks took on greater risk leading up to the subprime crisis. This is summarized by their leverage ratio, which is the ratio of total debt to total equity. A higher ratio indicates more risk. From fiscal years 2003-2007, these firms significantly increased their leverage ratios. A ratio of 10-15 is more typical of a conservative bank. These firms had ratios closer to 30. A highly leveraged institution can have its equity wiped out due to relatively minor swings in the value of its assets. For example, let's suppose an investment bank has $310 in assets, $300 in debt and $10 in equity capital. This is a leverage ratio of 300/10 or 30-to-1. It is an accounting identity (a rule that must be true by definition) that assets equals the sum of liabilities and equity. Now suppose the value of the assets declines by about 3% to $300. The institution still owes its debt holders $300, so equity must be zero. Many financial institutions are facing this scenario. To get more equity or capital, they typically issue new common stock shares to the public in exchange for funds. However, this dilutes the ownership of current shareholders, placing downward pressure on the stock price. When share prices have been reduced as was the case in 2008, a larger and more dilutive issuance of shares is required. In some cases, new share issuance is done at below the current market value. It is noteworthy that the leverage ratios at Morgan Stanley and Goldman Sachs were both under 15 as of Q1 2009, according to their Q1 financial reports available on their websites. Source Data thumb|Source data for the Graph Source data is the 2007 Annual Reports (SEC Form 10K) for each firm. Search the PDF for "Selected Financial Data" so you get the 5-year comparison. Bear's is a bit tougher to find through their website, as it is now part of JP Morgan. Lehman Brothers: http://www.secinfo.com/d11MXs.t5Bb.htm#1stPage Bear Stearns: http://www.bearstearns.com/sitewide/investor_relations/sec_filings/proxy/index.htm Merrill Lynch: http://ir.ml.com/sec.cfm?DocType=Annual&Year=2008 Goldman Sachs: http://www2.goldmansachs.com/our-firm/investors/financials/current/annual-reports/revised-financial-section-2007.pdf Morgan Stanley: http://www.morganstanley.com/about/ir/shareholder/10k2007/10k11302007.pdf

Título: Leverage Ratios

Créditos: Annual Reports; Chart by Farcaster

Autor(a): Farcaster (talk) 19:59, 16 October 2008 (UTC)

Términos del Uso: Creative Commons Attribution-Share Alike 3.0

Licencia: CC BY-SA 3.0

Enlace de Licencia: https://creativecommons.org/licenses/by-sa/3.0

¿Se exige la atribución?: Sí

Usos del archivo

La siguiente página enlaza a este archivo: